Who we are

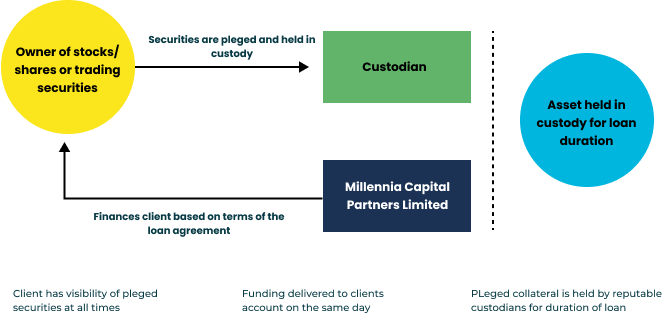

Millennia Capital is a leading private equity firm with a focus on Asian Markets in executing We specializing in cash equity and equity-related products. Our extensive portfolio of products includes stock loans, share loans, loans against securities and other equities